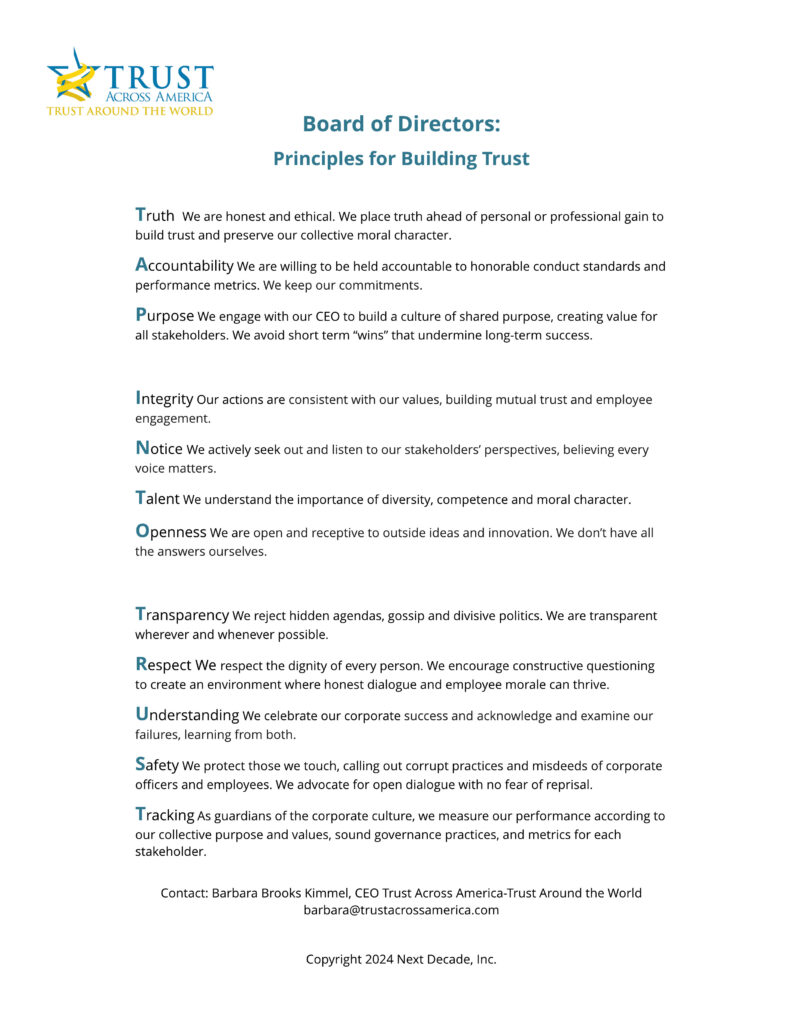

If you are a member of a Board of Directors or work with boards who want to build and model trust start with these guiding principles.

For more information and resources on building trust at the Board of Director level contact me directly at barbara@trustacrossamerica.com

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

Trust Across America-Trust Around the World (TAA-TAW) whose mission is to help enhance trustworthy behavior in organizations, announces its 2024 Top Thought Leaders in Trust. The awards program, now in its 13th year, celebrates professionals who are transforming the way organizations do business.

While a growing number of global “top” lists and awards are published, no others specifically address trust. Celebrating its 16th anniversary this year, TAA-TAW has been working with a growing team of global cross-functional professionals to research the “practice” of trust and build tools to support leaders, teams and organizations who choose to build, elevate or repair trust.

According to Barbara Kimmel, CEO, ”The release of our 2024 honors brings the focus to global champions of trust. Beginning this year we will be recognizing ten professionals who inspire organizations to look more closely at their higher purpose…to create greater value for, and trust from all of their stakeholders, and understand trust is a “hard currency” with real returns. All of our honorees have made a significant contribution to the field of trust over the past 12 months. Their expertise ranges from journalism to financial services.”

The honorees can be accessed via the Winter 2024 issue of TRUST! Magazine, available at no cost at this link, including complete details on our methodology, award winners, and additional trust resources.

Nominate now for our 2025 Top Thought Leaders at this link.

Trust Across America-Trust Around the World™ is a program of Next Decade, Inc., an award-winning communications firm that has been unraveling and simplifying complex subjects for over 20 years. TAA-TAW helps organizations build trust through an abundance of resources and ever-expanding tools. It also provides several frameworks for organizations to improve trustworthy practices, and showcases individuals and organizations exhibiting high levels of trust and trustworthiness.

Trust is the outcome of principled behavior. It’s always interpersonal and it’s always about people. If you want to intentionally build trust into your leadership strategy in 2024, stop talking and start acting. These are some tried and true strategies to get you started in the new year.

The mistruths about trust seem to compound by the day. What are some of the most common mistruths?

(and some stupid ideas about trust in business:)

The business case for trust is irrefutable. This document contains some of the best research/survey results.

As the saying goes, you can’t manage what’s not being measured. Start measuring and tracking trust:

Trust cannot be delegated. Understand who “owns” trust:

Trust must be modeled, practiced and reinforced daily. Leaders must act first: Trust takes time and is built in incremental steps. It always begins with you. If you do not model trust do not expect it in return.

Start hiring for trust. If trust is not built into an organization’s hiring practices, now is the time to start. Here You will find thirteen questions worth asking.

Have you stopped to consider that your employees may not trust you? Find out why your employees don’t trust you: The fix may be easier than you think, but only if you are open to learning.

And finally, if you are spending money on building trust with your customers while taking employee trust for granted, you are violating the most basic tenets of trust. As a leader, you may see short term positive results, but over the long term employee engagement will continue to stagnate. Remember, trust is always built from the inside out.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

For more information visit our website at www.trustacrossamerica.com

As the year draws to a close, I am pleased to provide the following visual summary of the progress we made at Trust Across America-Trust Around the World in 2023. For more information please visit our website at www.trustacrossamerica.com or reach out directly to me at barbara@trustacrossamerica.com

#1 Trust Across America’s Trust 200 Index Continues to Outperform the S&P 500 over time (12 years)

trustacrossamerica.com/documents/index/Return-Methodology.pdf

#2 Over 180,000 Have Tapped Into Trust

trustacrossamerica.com/tap-into-trust.shtml

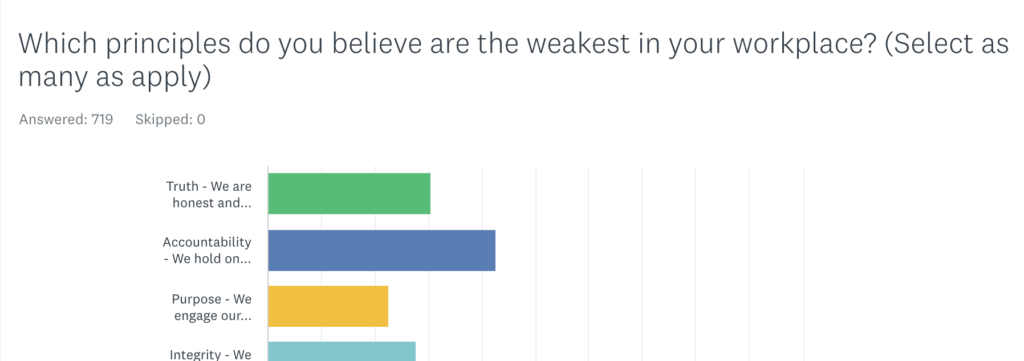

#3 Over 700 Have Taken Our 1 Question “Quiz” Identifying the Behaviors Weakening Workplace Trust

www.surveymonkey.com/r/Trust-One-Principle

Feel free to reach out with questions or comments. Best wishes for more trust in 2024.

Barbara Brooks Kimmel, Founder

One of our Trust Alliance members was recently hired by a leadership team to help identify why a certain division was underperforming. They contacted us to run our simple one minute AIM Trust Audit for both the leadership team and the division employees. Take a look at the results. The first chart is leadership (38 respondents) and the second is the division employees. (108 respondents).

A relatively wide gap revealed itself between the leadership team’s perception of the behaviors undermining trust compared to the employee’s perception. I wish I could say that these results are an anomaly, but they are not. How do you think the leadership team responded when provided with this data? What would you advise them to do next?

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

For more information visit our website at www.trustacrossamerica.com

1. Trust is not an input. It’s an outcome.

2. Trust cannot be broken in an instant.

3. The words trust, trustworthy and trusting do not have the same meaning and cannot be used interchangeably.

4. There is no trust “box” that can be checked.

5. Perception of trust does not equal trust.

6. There is no oxytocin “trust molecule.”

7. Trust cannot be regulated or “technologized.”

8. The most “popular” social media names in trust are not the most knowledgeable. They just have bigger budgets.

9. Using trust words du jour does not equal action. (Brand trust is not trust.)

10. Reducing quantifiable risk does not increase trust.

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

For more information visit our website at www.trustacrossamerica.com

Contrary to what many executives are lead to believe, trust is not a “soft” skill. In fact in today’s challenging business environment it may mean the difference between survival and failure. Trust impacts an organization in multiple ways, from profitability to workplace stress and wellness, stakeholder relationships, regulatory costs and beyond. The following represents some of the more current and less biased research/surveys supporting the business case for trust:

Profitability:

According to the proprietary FACTS® Framework research conducted by Trust Across

America-Trust Around the World, over a 10-year period the most trustworthy public

companies outperformed the S&P 500. 2022

Companies that actively and consistently build trust amongst consumers across their

entire spectrum of brands gain greater marketing efficiency. They face fewer

headwinds in marketing and selling their products and services, have more effective

advertising due to higher believability, and can charge a premium for their products.

Ipsos Mori Trust the Truth, September, 2019

Accenture Strategy Global Consumer Pulse Report surveyed 24,877 consumers

worldwide about their evolving expectations towards companies. Lack of trust costs

global brands $2.5 trillion per year. This compares to $756 billion lost by U.S.

companies and 41 percent loss of clients. 2017

Research shows that 30% of a company’s value is at risk where trust is broken with the

public and external stakeholders. Those CEOs who have a proactive approach to crisis

planning view simulation training and drills as an investment. They also see it as a way

to test and build the trust and confidence of their teams. It hones and develops

leadership and communication skills, builds coherence and cross-functional support. McKinsey & Company research in Connect: How companies succeed by engaging radically with society 2015 – John Browne, Robin Nuttall, Tommy Stadlen

Employee Engagement:

According to Gallup, when employees don’t trust organizational leadership, their

chances of being engaged are one in twelve. But when that trust is established, the

chances of engagement skyrocket to better than one in two. A highly engaged

workforce means the difference between a company that outperforms its competitors

and one that fails to grow. Currently 31% of the working population are engaged.

Taking into consideration three Gallup measures of employee engagement this year,

the overall percentage of engaged workers during 2020 is 36%. July, 2020

Workplace Stress & Wellness:

Research on the link between trust and wellness in SmartBrief article. 2020

The level of trust in the work environment is also associated with increased

adjusted odds of having cardiovascular disease. International Journal of

Environmental Research, 2019

Research from 2018 suggests that “trust and perceived support are both significant

predictors of mental and physical health, job satisfaction and turnover intentions.

However, the support at the team level is a more important predictor, while trust is

a stronger predictor at the organizational level. Italian Society of Occupational

Medicine, 2018

According to PwC, when we look at employees, 22% have left a company because of

trust issues and 19% have chosen to work at one because they trusted it highly. In

other words, one out of five of your employees who leave don’t do so primarily for a

better salary or position. They leave because they don’t trust your company. PwC Trust

in US Business Survey, August 2021

Improved Stakeholder Relationships:

Only 7 percent of Americans believe that major company CEOs have high ethical

standards, and only 9 percent have a very favorable opinion of major companies.

Only 42 percent Americans trust major companies to behave ethically, down from

47 percent last year. Public Affairs Council, 2018

Regulatory Costs:

The Competitive Enterprise Institute reports that The cost of Federal Regulations is

approaching $2 trillion annually. To put that number in perspective, if U.S.

regulations were an economy, it would be larger than Canada’s entire GDP and the

eighth largest in the world. The regulatory state costs more than the U.S.

government collects from income taxes. It’s almost equal to all corporate pretax

profits earned in 2016. Investor’s Business Daily April 19, 2021

Barbara Brooks Kimmel is an author, speaker, product developer and global subject matter expert on trust and trustworthiness. Founder of Trust Across America-Trust Around the World she is author of the award-winning Trust Inc., Strategies for Building Your Company’s Most Valuable Asset, Trust Inc., 52 Weeks of Activities and Inspirations for Building Workplace Trust and Trust Inc., a Guide for Boards & C-Suites. She majored in International Affairs (Lafayette College), and has an MBA (Baruch- City University of NY). Her expertise on trust has been cited in Harvard Business Review, Investor’s Business Daily, Thomson Reuters, BBC Radio, The Conference Board, Global Finance Magazine, Bank Director and Forbes, among others.

When I was asked recently how trust has changed over the past decade my first thought was that trust has been taking a pretty bad beating recently. According to most major surveys, including the annual Edelman Trust Barometer, Gallup, Pew Research Center, and others, trust has been declining. The people, groups and institutions we trust keep rearranging themselves in our collective minds, with some gaining in trust while others fade. But overall our trust in each other and our institutions has been trending downward.

But if you think about it, how we experience trust now is the same as it ever was. So is the value of trust – what it does for us – in business, politics, society, and life. As Stephen Covey has written, “Trust is the foundation for everything we do….” It is part of every relationship we have and undergirds everything we want or need to do together.

The Unchanging Experience of Trust

Our bodily experience of trust (and distrust), the sensations we feel, and the underlying neurophysiology that produce them have been with us for millennia. We are hard-wired to trust and to distrust, and we need both. Trusting others allows us to work together to accomplish what none of us can do alone. Distrust is built into our biology to help us stay alive and safe.

What we are predisposed to do when we trust or distrust someone, or a group of someones, is also pretty much the same now as when humans were living in small clans and painting stuff on cave walls.

When we trust others we feel safe enough to be open and at ease with them. At work this translates to collaborating effectively and have fun doing it. We happily share our ideas, good, bad and everything between, with people we trust. When we trust an information source we form opinions and act based on what we hear from them. When we trust a company, we tend to buy from them and invest in them. Trust naturally draws us toward who and what we trust.

Distrust, on the other hand, insists we act to protect ourselves. People, groups, companies, and institutions we don’t trust we avoid like the plague if at all possible.

In Whom We Trust (or not)

When you think “I trust this person/group/company/organization” you are making an assessment that their future behavior won’t harm and in fact will support you. That assessment leads to the embodied experience of trust described above, together with feeling certain emotions that travel with trusting, e.g., generosity, curiosity, hope, happiness, care. The same is so with the assessment “I don’t trust” except the sensations and emotions are distinctly different.

Which brings me to what has changed in the past decade and continues to change: who we trust, and to what extent we trust/distrust them. Trust has never been really high among us as a species, but according to several recent studies we are trusting less. Many parts of the foundation Covey talked about are crumbling.

For example, the Edelman Trust Barometer, an annual global survey of trust levels in business, government, NGOs, and media, has found a profound shift over the past decade in which of these institutions we place more and less trust.

Their 2023 study also reports people worldwide are becoming more polarized in general. Increasing polarization, the Edelman report shows, is both a driver and result of distrust. And the trend is not going in a positive direction.

Surveys by PwC, Pew Research Center and the Knight Foundation have looked at the trust employees and customers have in companies vs. what company leaders believe, and our trust in science and media, respectively. Again, they find changes in who we trust/distrust, with an overall downward trend over the last decade.

Couple decreasing trust with what we know about what we do when we distrust others and we have the makings of a slow-moving disaster. Unless we start turning this ship around we will see diminishing cooperation with increasing polarization, more balkanization in politics and society, less willingness to talk things out as people pull back from those they distrust.

Trust-Building as Necessary Work

I believe now more than ever it’s time for those of us who work in the field of trust-building, who have the tools and expertise, focus on helping the people we work with become competent trust-builders in their chosen fields. We understand that trust-building is a competency that can be learned, developed and practiced. We have frameworks and tools to support people as they try to build their own trust-building capability.

It is also time for leaders everywhere to step up and put learning and practicing trust-building at the forefront of their work. Doing so can reverse the downward trend of trust in the world around us.

Stronger trust between people at work (where we spend most of our time) and in our communities, and between us and the institutions that hold together the fabric of those communities, is going to be essential for us as a species to make it through the big storms looming on the near horizon: climate change, political and social upheaval, and the potential threats posed by AI.

Did you ever buy a product from a company you didn’t trust? The decision sits in the craw of your throat. Uncomfortable, but perhaps without a choice, the process moves forward with the hope that you will be proven wrong, and everything will be okay this time. But unfortunately, your instincts are usually proven right. After all, there is a reason why a company hasn’t achieved trust with you. They are not trustworthy.

Trustworthiness is a vital component of every corporate interaction. It is the lubrication of commerce. Without trust in the organization, the company will ultimately cease functioning effectively or efficiently.

Building trust between the company and its customers starts with the CEO. Still, it is also the responsibility of every individual in the company where contact is made with the consuming public. Trust takes time to build but can be lost instantly if communication isn’t sincere or the intention isn’t authentic. Trust is vital to the health and vitality of the corporation, and it needs to be embedded in the company’s DNA.

Consciously think about your interactions with the products or services you purchase daily. For example, consider your level of trust at the point of sale when you offer your credit card to complete the transaction. Not every purchase will be made with 100% confidence in the company and ask yourself what they might do differently to gain your trust. That kind of critical thinking and planning puts companies on the path of utilizing trust to build it into a valuable intangible asset that can be measured and managed for value creation.

Will management invest in building a trustworthy organization?

Trust is an intangible quality that exists between individuals. Trustworthiness is organizational trust, which is an intangible asset of the company. Trustworthy companies, in my opinion, will benefit from higher revenue and a greater cash flow multiple (premium investors are willing to pay for a share of stock) than peer companies with lower trust scores. This belief is based on thirty years of proprietary quantitative research called the Corporate Branding Index® (CBI), which found that individuals like to buy from and invest in companies they deem familiar and favorable.

The research conducted in the CBI examined descriptive attributes quantitatively and longitudinally over time among an audience of impartial observers. This study included thousands of interviews conducted annually among hundreds of companies, which created a rock-solid benchmark for evaluating how intangible assets impacted the corporate brand and financial performance of the firm, including the stock price. In addition, corporations utilized the study to understand how business decisions affect the corporate brand and, ultimately, the company’s long-term financial performance.

The attributes measured in the CBI included overall reputation, perceptions of management, investment potential, and a culture of innovation. When measured together, these attributes were utilized to predict financial performance when all other financials are held constant. In addition, the models were proven effective for decision-making and examining “what if” questions of importance to the CEO and board of directors.

Is trust measurable and manageable?

Barbara Brooks Kimmel, CEO of Trust Across America, has developed a consistent way of measuring trustworthiness that is consistent, independent, longitudinal, and reliable. These are the elements required in building independent variables when valuing intangible assets.

Trustworthiness as an intangible asset that can be managed and measured for value creation. Trustworthiness is a collective perception of an entity from the perspective of every audience that is important to the entity. Key audiences include employees, customers, investors, media, and local communities. While the research methodology between the CBI and Trust Across America differs, the overall concept and top line findings run parallel. As a result, I believe trustworthiness is a powerful intangible asset that significantly impacts the company’s brand and, ultimately, its financial performance.

Trust is the most vital intangible asset of any personal or business relationship. Trust is a primary component of every interaction, quietly influencing and persuading every decision. Trust is a delicate but persuasive intangible that can sway important and valuable assessments. Any perceived breach of trust will end a negotiation no matter how sweet the deal is being considered. Trust is the final trigger for most business investments, as an individual can contemplate the cost/benefits of a purchase for hours. Still, the commitment is made to the actual purchase because the buyer trusts the seller.

Building trust creates a premium value for product brands and enterprise value for the corporate brand. Trust is the most valuable intangible asset and can be managed like any other asset. Having a clear vision and training employees to communicate consistently over time is the best way to build the value of trust.

Customers want to buy from companies they can trust. Investors want to invest in companies they trust. The media would like to write articles about companies that give them the straight scoop. Employees want to work for a trustworthy company. What every stakeholder has in common is a desire to be treated with honesty and respect, which is the essence of trust. Therefore, understanding how to measure and manage trust makes good business sense.

Dr. James R. Gregory founded NYLAQ Advisors – Managing Intangible Assets for Value Creation. Jim also serves as chairman emeritus of Tenet Partners, a global brand innovation and marketing firm based in New York, NY. With 40 years of experience in advertising and branding, Jim is a leading expert on corporate brand management and is credited with developing strategies for measuring the power of brands and their impact on a corporation’s financial performance. Most notable of the tools that Jim has developed is the CoreBrand Index (CBI), a quantitative research vehicle that continuously tracks the reputation and financial performance of over 800 publicly traded companies across 50 industries. For additional information, please visit www.NYLAQ.com

Recently, I presented at a conference for leaders running businesses with participants from over one hundred and fifty countries. Having spoken on trust in more than fifty-eight countries on-site—and in even more virtually—I’ve noticed that although every culture is beautifully unique and different, there is one common thread that runs through them all: trust. Regardless of the setting or the circumstances, each culture and country is shaped by trust – or the lack thereof. Every society, organization, team, group, and family functions well only to the degree there is trust. Indeed, it can be said that trust “makes our world go ‘round.”

If it feels like your world isn’t going ‘round right now, or it’s going slower than you’d like, I recommend looking at trust first. The reality is, that low trust is almost always the root of the problem – or the most impeding barrier to the solution. Indeed, most organizational performance issues are really trust issues in disguise.

Never before has the impact of low trust been more prevalent or apparent. More and more we see examples of this play out on the news, as well as in our own organizations, communities, and neighborhoods. On top of that, we have more research and data on how trust drives performance available at our fingertips than at any other time in history. We know this is important. And yet, deliberately moving the needle on trust, which is vital for everyone and everywhere, continues to present an enormous challenge. Why is that?

Trust the Noun

For me, it begins with understanding what Trust means. Trust as a noun is both complex and eye-opening.

Take for example, this exercise that I invite teams and audiences to participate in when I speak on this topic. Consider the statement below:

It is possible to have two trustworthy people working together and to have no trust between them.

Take a few moments to ponder the significance of that statement, because in all my years of teaching trust, this is perhaps one of the most profound insights I’ve learned.

Read it again. What stands out to you?

The idea that you can have two trustworthy people working together and also have no trust between them continues to be one of the biggest challenges I run into when working with people— regardless of the situation. Whether it be on a team, between teams, in an organization, in the relationship between partners and customers, or even just on a personal level, this problem comes up again and again.

It exhibits itself as misalignment between departments, a lack of collaboration, weak retention, lethargic execution, an inability to innovate, and formation of silos. It becomes greatly magnified in the context of nearly every form of organizational change. It becomes a silent stumbling block on the road to innovation and progress. Have you experienced this or seen it in your own organization? The majority of people can relate to the frustration that comes hand in hand with low trust.

However, the statement I shared is only part of the insight. Take a moment to consider the completed message:

It is possible to have two trustworthy people working together and to have no trust between them . . . if neither person is willing to extend trust to the other.

When most people think about trust, they simply think about trustworthiness – the level at which someone can be relied upon or trusted. Although insufficient by itself, trustworthiness is still a good place to start because it’s difficult to have real, meaningful trust between people when one or both parties isn’t worthy of it.

But here’s the kicker: in my experience, our most significant challenge is not a lack of trustworthy people. Everywhere you go, you can find good, honest, trustworthy people to work with. So, that is less often the issue. Rather, the bigger challenge is trustworthy people who do not extend trust to other trustworthy people. Those same good, honest, trustworthy people are often the ones who find it hardest to give trust to others.

I can’t tell you how many leaders I’ve worked with who are credible and authentic, who care deeply about both their work and their people, who are excited and eager to make a difference for their organization – and yet who just can’t seem to extend trust, or enough trust for it to really matter. They are trustworthy but are not trusting. Both dimensions are vital. And because trusting is reciprocal, it goes both ways: employees and team members who are distrusted by their leaders learn to withhold trust from those same leaders. And the cycle and impacts of low trust continue onward. To achieve Trust in its ultimate noun form, we must have both components present and operating – trustworthiness and trusting.

The Good News

Although your organization might not currently be operating at the level of trust you want, I believe this insight provides hope that it can. If our teams and organizations really are full of trustworthy people, it means there is enormous potential waiting for us on just the other side of a meaningful extension of trust. There are enormous benefits we have yet to reap if we shift our focus from not only being trustworthy but also to being trusting.

Gail McGovern, twice named one of the “50 Most Powerful Women in Corporate America” by Fortune Magazine, is a model of being trusting. When she became CEO of The American Red Cross, she inherited a $209 million operating deficit, along with a Board mandate to eliminate said deficit within two years. On top of that, she was the 10th CEO of the prior decade. Walking into the struggling non-profit and assuming trustworthiness at scale may not have been the most natural position to take.

Knowing the difficult circumstances the organization faced, and how temporary the CEO role had been, Gail arranged a series of town hall meetings around the country—what she called a “listening tour”—with the intent to listen to and connect with employees as a foundation of developing a turnaround plan. During one such meeting, an employee bravely asked the question on everyone’s mind, point blank: “Gail, you’re new and we’ve gone through a lot of leaders. How do we know if we can trust you?”

Gail responded thoughtfully, “You’ll have to decide that for yourself but I certainly believe you’ll find in me someone you can trust.” Then she leaned in and emphatically declared to everyone in the room, “But let me tell you that I trust each and every one of you.”

This was an easy thing to say yet hard to do. But Gail meant it. She was trustworthy when she arrived, bringing with her an excellent track record, but that wasn’t what inspired her employees to trust her. It was her early decision to practice trusting others that people responded to powerfully. This strong start inspired her people and helped them to buy into her plan and vision for the organization. This unified front served them well as they were able to eliminate the deficit and kick off a turnaround that continues to this day to perform and serve society in profound ways.

Trusting Globally

Another great example of trusting is Daniel Grieder, the CEO of global fashion retailer, HUGO BOSS, out of Germany. When Daniel was brought in from outside the company to serve as the new CEO, he immediately met with his top leadership team, and outlined, in essence, two possible paths forward. In that meeting, he laid out his vision and invitation for the future:

“Team, you don’t know me, and I don’t know you. So, we have two choices: we can spend the next year deciding whether or not we can trust each other . . . but then we’ll have wasted a year. Or we can decide to trust each other from day one. I choose the second option. So please know this: I trust you. Please trust me too. Trust is how we we’ll create a new way of working together, and a new culture.”

Can you imagine the impact this immediate extension of trust had on those in the meeting? In fact, I recently had the opportunity to meet with Daniel and his team, just about two years into his tenure and the results were obvious. In those early days, the company had created a five-year strategic plan and, even though only two years had passed they were already on year four of the plan! Indeed, they were operating at the speed of trust. The decision to trust each other internally had long since been made, and their external performance—as well as internal culture—was the proof. Through trust, Daniel and his team were able to build a strong culture of trust that allowed them to collaborate more frequently, innovate more fully, and achieve their goals more quickly. They were winning in the marketplace as a result of winning in the workplace first. Daniel was trustworthy but he also trusted his people who in turn trusted him and together they were able to achieve remarkable results.

Imagine how differently things might have gone in both scenarios had Daniel or Gail chosen not to extend trust.

What About You?

Stories like this are inspiring but may also feel overwhelming due to their scale. But in my experience, the results of extending trust are just as impactful and magnificent on a personal level as they are on an organizational or global level. Perhaps this can be seen most clearly, as you consider these three favorite questions of mine.

The first is simply, “Who trusted you?” I often ask people to identify someone in their life who trusted them. Someone who saw potential in them that maybe they didn’t even see in themselves, someone who believed in them, someone who took a chance on them. Almost without exception, everyone can quickly, if not immediately, think of someone (and sometimes more than one). Whether it was a parent, a boss, a teacher, a coach, a friend – we all remember those people who trusted us and believed in us.

The second question I like to ask is, “how did that extension of trust impact the way you saw yourself?” We know these people had a great impact on us but there is something special about articulating how exactly they did and how it changed and inspired us. Regardless of the situation, deep down we all want to be trusted – and when we are, it does something for us. Being trusted is the most inspiring form of human motivation. Being trustworthy is vital—but sometimes the very thing that makes a person worthy of trust is when they find themselves on the receiving end of it. People more often than not rise to the occasion when they are given the chance to prove themselves.

Having thought about the person who trusted you and how it impacted your life for the better, my third question is, “For whom can you be that person?” The cycle of extending trust shouldn’t end with you. There are people out there waiting for someone to offer them the chance to shine. You can be that person for them.

I invite you to consider all three of these questions. No matter your circumstances – whether as CEO of a company, a manager of a small team, an hourly employee, a stay-at-home parent or simply as a human being, you have the opportunity to change lives through trust. Your organization, your team, the trustworthy people in your life can reap the benefits as you extend trust to them. And you will find in turn that they will extend trust to you. And this uplifting cycle, no matter where on the globe you might be, will indeed make your world go ‘round.

by Stephen M. R. Covey (bestselling author of The Speed of Trust and Trust & Inspire)

Recent Comments